Latvia is the first of the Baltic states where, starting today, payments can be made using smartphones. The mobile payment solution has been developed by the bank Citadele together with the international card company Mastercard. The solution was introduced over 8 months, with an investment of over one million Euro.

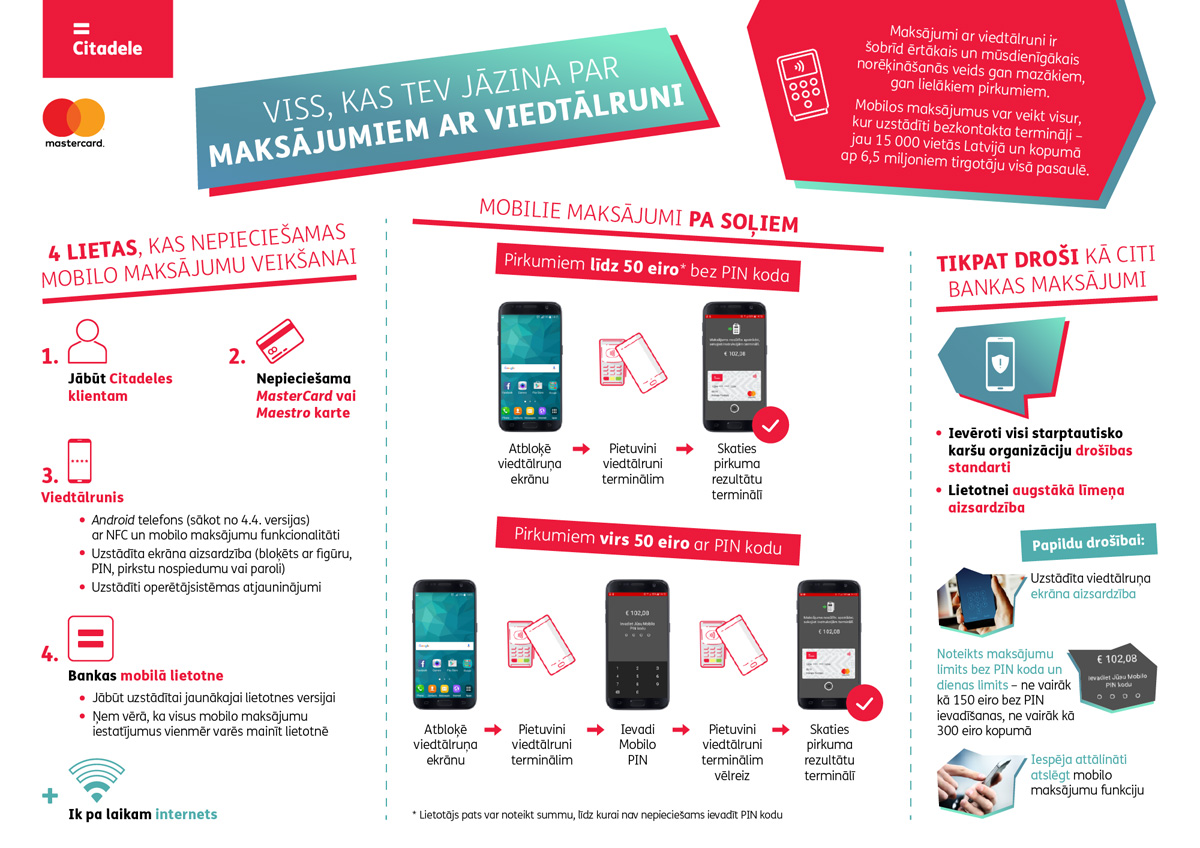

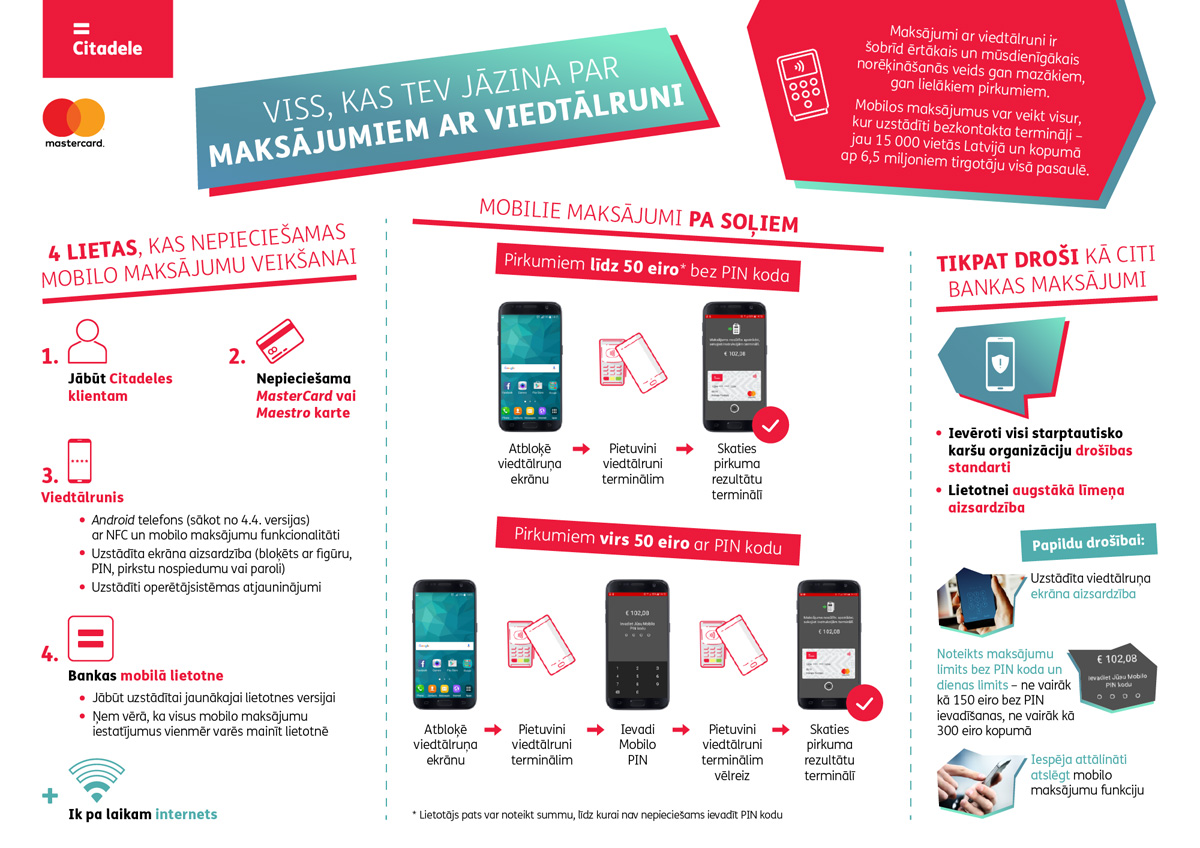

To pay using a smartphone, it must be held near the terminal, like a contactless card, until the screen shows confirmation of payment. Purchases can be paid for by smartphone in places where contactless terminals have been installed - 15,000 places in Latvia1 and in total at 6.5 million retailers worldwide2.

“With developing technologies, we have the opportunity to offer more up-to-date services. 35% of the population already wants to make payments with a smartphone, however, it will be some time before use is widespread. Our experience shows that as soon as people have tried out something convenient and modern, they would rather not return to previous solutions,” explains head of Citadele business strategy implementation and business development Vladislavs Mironovs.

"This is an important turning point in the payment industry in the Baltic states. Thanks to Citadele and Mastercard’s effective collaboration, we have revealed an innovative solution for secure and simple everyday payments,” says head of Mastercard Baltics Johan Modeniuss.

When testing the payments, Citadele’s mobile payment implementation team observed that the advantages of mobile payments are appreciated in places with longer lines or where people are in more of a hurry. Additionally, mobile payments were actively used when wallets were left at home, for example when going out for a walk or engaging in sporting activities. Most often, mobile payments were used in retail outlets, petrol stations, pharmacies and self-service carwashes, it was discovered during the mobile payment testing period.

Purchases by smartphone for Android users

Payments by smartphone are available to all Citadele customers who use smartphones on the Android operating system and are Mastercard or Maestro card holders. These payments can be activated in the mobile app. There, you can also change the payment limits up to which users can pay without entering their mobile PIN code.

Mobile solutions for users of other operating systems

For users of other operating systems, Citadele is offering alternative mobile payment solutions - bracelets and stickers with contactless technology. Payments will happen just like with a smartphone - the sticker or bracelet must be held near the terminal.

Just as secure as other bank payments

Smartphone payments, just like other services offered by the bank, are secure. Mobile payments observe the security standards of all international card organisations, and the highest level of security has also been developed for the mobile app. “For extra security, payment limits have been set - payments without a mobile PIN can be made up to 50 Euro or a smaller sum set by the user, but for larger sums the PIN is obligatory. Furthermore, if needed, it is possible to shut down the mobile payment function remotely,” says Citadele head of IT and technology strategy and development Slavomir Mizak.

Smartphones are increasingly beginning to fulfil the functions of other devices, therefore their owners are urged to ensure their security - by blocking the screen with a figure, PIN, fingerprint or password, as well as by regularly updating the mobile app and operating system.

Mobile payments will become increasingly popular

In many countries mobile payments have become a part of daily life. It is predicted that in 2020, 38% of card payments in Europe will be made digitally, for example, with a smartphone or other device.

The mobile payment solution is a Citadele original service which was undertaken jointly as part of the innovation programme by Citadele employees from three teams: card and mobile payments, e-business, and IT, in cooperation with the business “D8 Corporation”.

Photos

-----

1 Latvijas Komercbanku asociācijas dati

2 MasterCard dati